Contact Center Software For Banking and Finance

Omnichannel and Its Benefits

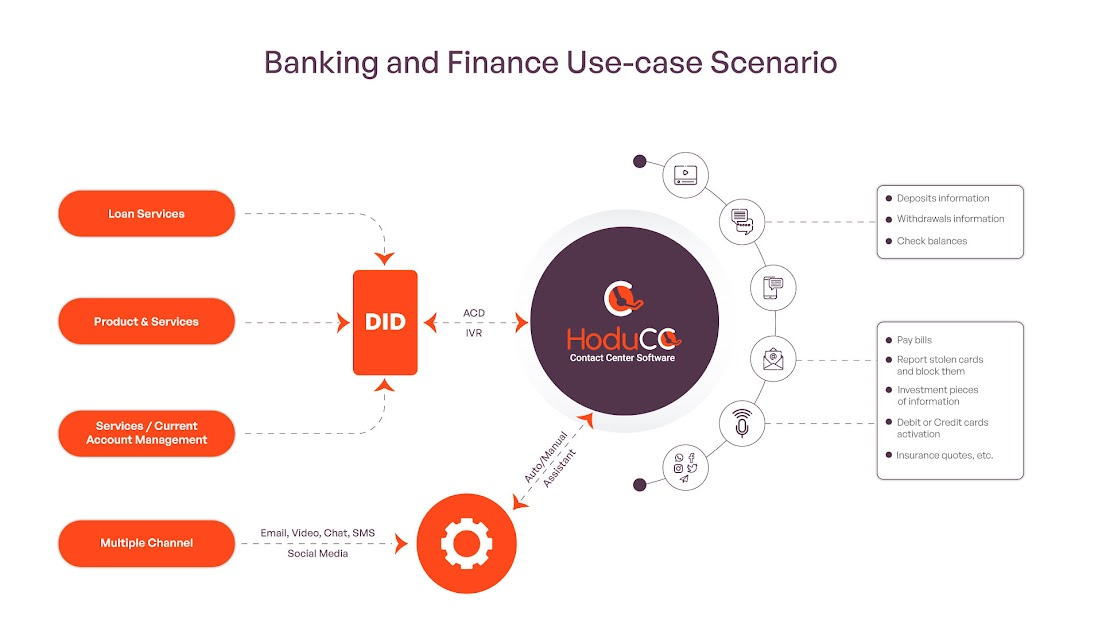

With HoduCC Omnichannel Customer Care Software for Banks and Financial institutions, it becomes easier to provide seamless customer service with efficient handling of incoming and outgoing calls, texts, SMSs, faxes, video calls, and more.

Keep Accurate Records of Customer Interactions for Smooth and Long-Lasting Working Relationships

Why Do Banks and Financial Companies Need Contact Center Software?

- Provide account-related details, submit inquiries, approve or reject transactions, activation of Debit or Credit cards, and more with customization options.

- Route customers to the right department and the most appropriate person based on their query/issue.

- Provide consistent customer service with the help of Interactive Voice Response (IVR), call recording, call transfer, call barging, third-party integrations, and various other features.

How HoduCC Contact Center Software Can Help Banking and Financial Companies?

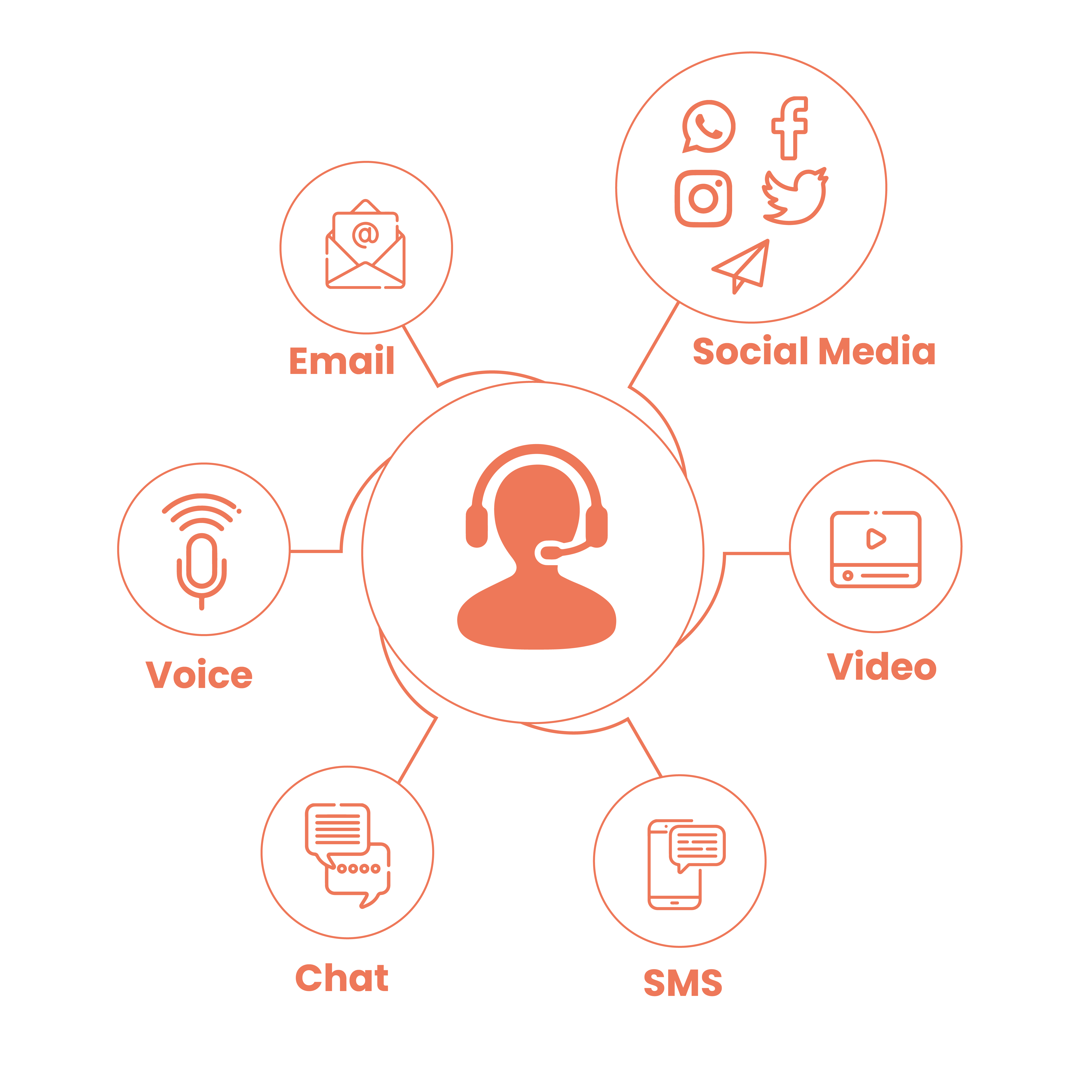

- Omnichannel Platform

- Intelligent Call Routing

- Auto Dialers

- Single Tenant and Multi-Tenant

- Cloud-Delivered and On-Premise

- WFH and Hybrid Work

- Enterprise-grade Security

- Call Recording Encryption

- Smooth Integration with CRM Applications

- Reporting & Dashboards for Data-driven Insights

HoduCC Is a Feature-Rich Customer Service Software for the Banking and Financial Industry

Predictive Dialer

An ideal tool for businesses with large call volumes. Our predictive dialer contact center software uses advanced algorithms for better productivity.

Skill-Based Routing

Drive customer engagement with preferred proficiency routing. Customers are routed directly to the agents with relevant skills.

Automatic Call Distribution

This feature is intelligently built to automatically sort and manage heavy call volumes. It helps to distribute calls evenly among contact center agents.

WebRTC Phone

In-built web phone based on WebRTC technology, allowing users to connect securely via popular desktop/laptop browsers instead of a dedicated office phone device.

Auto Dialer

Auto-dialers enable the system to simply redirect the call to the next agent. Automation helps in the efficient usage of resources and improves productivity.

Single Tenant & Multi Tenant

Enjoy the powerful single-tenant & multi-tenant features for the contact center.

Multilevel IVR

Drive superior efficiency and personalization via smart multi-level IVR functions and call flow design.

Real-Time Analytics & Reports

Monitor and analyze all customer interactions with live call monitoring and a campaign dashboard to redefine your customer support experience.

Built-In CRM

Allow customer service agents to access customer information like previous interactions, unresolved complaints, account details, and more to deliver contextual conversations.

Omnichannel support

Connect with your customers easily across different channels including voice, video, Email, social media, chat, and SMS. This helps in offering consistently great customer experiences regardless of the communication channel they use.

AmpliTech: Supercharging Software with Add-On Modules

Feature to help businesses handle multiple conversations simultaneously while providing 24/7 support to customers, answering questions, and resolving issues in real time.

Provide round-the-clock service with the WhatsApp Bot. It is capable of answering regular support queries. It can answer questions thoroughly in a conversational approach.

High-precision speech recognition system transcribes calls, boosting agent productivity. Allows for easy analysis and auto-capture of important data.

An add-on module in HoduCC for ranking the agents based on their voice tone, language proficiency, quality of query the resolution, or any predefined ranking criteria for agents.

The admin can create a WhatsApp campaign and select the pre-approved WhatsApp message template they want to broadcast to their customers through WhatsApp broadcasting functionality.

Admin can create the SMS campaign and type the text that they want to broadcast to their customers through SMS broadcasting functionality.

Once regular communication between the customer & agent is over, the agent can transfer the call to Interactive Voice Response (IVR) for post call survey. IVR Survey provides a set of survey questions to the customer.

Why Should You Choose HoduCC for Your Banking and Financial Business?

HoduCC is a cost-effective, secure, and reliable choice in the contact center solutions space. Besides, many other reasons that make HoduCC the best software for banking and financial companies include:

- HoduCC is a feature-rich software for banking and financial companies.

- It helps in automating various manual tasks, thereby ensuring fast issue resolution.

- It helps banks and financial companies in tracking customer information like customer credentials, account details, transactions, etc.

- It provides easy integration with all the major SMS (Twilio and TELNYX) and CRM (Salesforce, ZOHO, and Zendesk) platforms.

- It facilitates real-time data exchanges between agents and other users.

- It helps in effectively managing banking and financial operations and customer relations in a go.

- It helps in reducing overall costs by cutting down the extra hours of operations, streamlining processing operations, and allowing employees to work more efficiently.

Customer Testimonial

With tools to make every part of your process more human and a support team eager to help you, getting started with the software your choice has never been easier.

Our presence

Customers who trust us

Nice guys, reliable software, reliable customization services, good support services.

The 24 x 7 support provided by the team is incredible. I personally have never seen such a dedicated team who always are focused on customer benefits.

Overall experience has been good. We have been using it from last a year now and so far experience is fine.

Frequently asked questions

Everything you need to know about our product and Software. Can’t find the answers you’re looking for?

- Facebook – Post/Comments and Messenger requests

- Instagram – Post/Comments requests

- Twitter – Direct Message requests

- WhatsApp – Inbound chat requests from customers to WhatsApp Business Account and Agent can send one-to-one Outbound WhatsApp to customer based on the pre-approved template(s) from WhatsApp

- Telegram – One-to-one chat requests