Omnichannel Strategies for BFSI: Enhancing Customer Experience with Contact Center Software

Do you know the top priority of today’s customers? It is none other than a seamless and personalized experience. Especially when it comes to the BFSI (Banking, Financial Services, and Insurance) sector, offering seamless, personalized services is key to securing lasting customer relationships.

However, in today’s digitally driven era, competition is getting fierce day by day, making it challenging for BFSI institutions to keep up with customer expectations. To boost sales and overall customer experience, these institutions must leverage the power of technology such as omnichannel contact center software along with personalized communication strategies to create a seamless omnichannel experience.

As per a report, by taking steps to build more meaningful personal relationships, banks could boost revenue from primary customers by up to 20%. Another report suggests that about 44.5 percent of organizations worldwide perceive customer experience (CX) as a primary competitive differentiator.

Therefore, it would be correct to say that customers these days expect more flexibility and convenience than ever before. To fulfill these demands of the customers, organizations in the BFSI field require well-planned omnichannel strategies.

In this blog, you will get to explore the importance of omnichannel strategies in enhancing CX and how contact center software can support omnichannel strategies in the BFSI sector. Let’s get started!

- What is BFSI?

- What Do You Understand by Omnichannel Strategies?

- How Omnichannel Strategies Help in Enhancing Customer Experience?

- The Role of Contact Center Software in Omnichannel Strategies

- Key Features of Contact Center Software for BFSI

- Benefits of Omnichannel Strategies with Contact Center Software

- Implementing Omnichannel Strategies in BFSI

- Future Trends in Omnichannel Strategies for BFSI

What is BFSI?

In the financial sector, BFSI stands for Banking, Financial Services, and Insurance. Companies that provide a variety of financial products and services fall under the umbrella term BFSI. .

What Do You Understand by Omnichannel Strategies?

In the field of BFSI and marketing, omnichannel strategies refer to the customer-centric approach that integrates different channels like voice, SMS, live chat, email, social media, etc.

Omnichannel strategies are generally built to provide a unified and consistent customer experience across different platforms whether they are visiting via physical stores, apps, or websites. It allows customers to seamlessly interact with the brand, thereby enhancing the overall brand experience.

How Omnichannel Strategies Help in Enhancing Customer Experience?

Omnichannel strategies help in augmenting customer experience by creating seamless, unified, and personalized interactions across varied channels. Well-crafted omnichannel strategies help in-

Maintaining Consistency Across Channels:

Omnichannel strategies let businesses ensure a consistent experience for customers whether they are interacting via a physical store, a website, a mobile app, social media, etc. Consistency across channels also leads to enhanced brand identity and trust.

Ensuring Personalization:

Since omnichannel strategies integrate data from various channels, it allows businesses to better understand customer preferences and behaviors. This further helps call center agents in delivering personalized services and carry out targeted marketing. With easy access to past interactions and purchase history, call or contact center agents can tailor their interactions, thereby enhancing the relevance and appeal of messages and offers.

Delivering Convenience and Flexibility:

The omnichannel approach also ensures seamless transitions. It means that customers can initiate their approach via one channel and complete it on another without disruption. For instance, customers can browse certain products online and purchase them online, or vice versa. Similarly, for any issues or help they can first connect via SMS or email and then directly speak to the agent via call, without the need to repeat the issue again.

Improving Customer Service:

An omnichannel system allows customer service representatives to access the entire customer interaction history, empowering them to resolve issues more efficiently and effectively. Besides, the ability to offer support via different channels ensures customers can get the required assistance via their choice of channel. All this contributes to enhanced customer service and overall experience.

Accessing Data-Driven Insights:

Comprehensive data analytics can be obtained via omnichannel strategies. Businesses can use this data to gain better insights into customer behavior and preferences across channels. This further helps in making informed decisions. Moreover, advanced analytics allows businesses to predict customer needs and behavior and address them proactively.

Fostering Loyalty:

Using an omnichannel approach, businesses can easily gather and integrate feedback from various channels. This helps them to refine and improve customer experience by creating a more connected, efficient, and personalized customer journey. When customers receive quick and personalized service, this leads to higher customer satisfaction and fosters loyalty.

Top Call Routing Strategies to Improve Customer Experience

The Role of Contact Center Software in Omnichannel Strategies

Before talking about the role of contact center software in omnichannel strategies, let’s talk about one of the most common issues that customers face when they want to reach a customer service representative. It is none other than waiting for a long time to get connected to an agent. Isn’t it?

Are you aware of the fact that the amount of time a customer has to wait on hold before connecting with an agent has a direct impact on customer experience and satisfaction? Yes, as per a report, prolonged hold time is the most common customer complaint. About 44% of customers become annoyed or angry when they wait on hold for 5-15 minutes.

Annoyed or frustrated customers are more likely to feel undervalued and they may look somewhere else to meet their expectations. Here the first call resolution (FCR) metric plays an important role. It is an in-depth measurement used by contact centers to understand multiple aspects, from customer satisfaction to the customer service team’s skills. About 95% of customers will continue to do business with the organization due to achieving FCR.

With an omnichannel approach, contact centers can handle customer queries via their preferred channels like voice, video, text, SMS, email, and social media. This can help enhance FCR as goals can be assigned for each channel. Using the right omnichannel CX suite, agents with the required expertise and FCR ability can be assigned to each channel so that each customer’s query can be handled promptly without making him/her wait for long. Now let’s discuss the role of contact center software in omnichannel strategies.

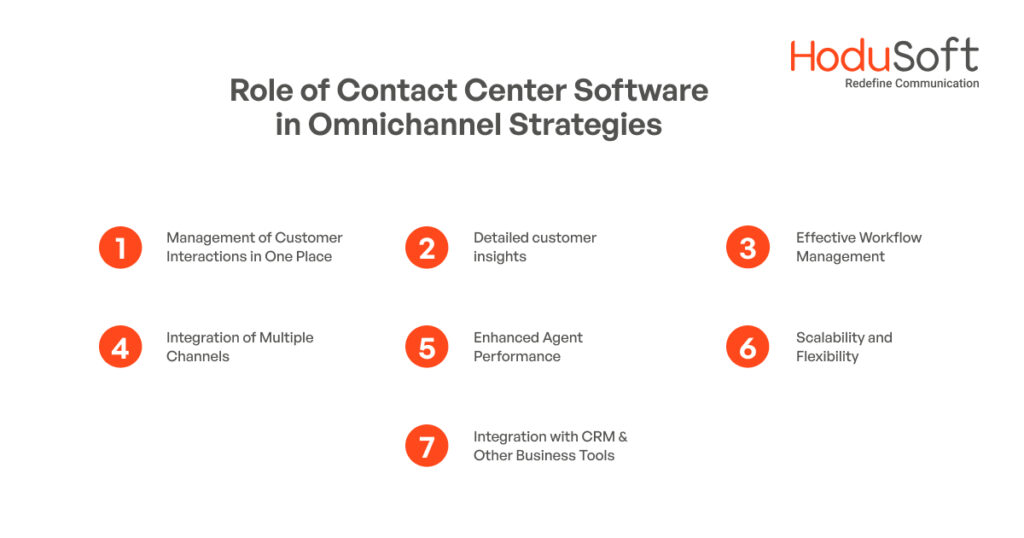

Contact center software plays a key role in the successful execution of omnichannel strategies. Since, omnichannel strategies are designed to provide seamless customer experiences across channels, opting for an omnichannel contact center can support omnichannel strategies in assorted ways-

Management of Customer Interactions in One Place:

A centralized interface enables agents to manage all interactions from one place, as various communication channels are integrated into a single interface. Moreover, the consistent experience ensures that no matter which channel a customer uses, they’ll get a consistent and cohesive experience.

Integration of Multiple Channels:

As mentioned above, an omnichannel contact center software supports multiple communication channels, including voice, video, email, chat, SMS, and social media, allowing customers to choose their preferred communication channel. It also ensures smooth switching between channels without the need to repeat queries or issues again and again. Therefore, without losing the context of their interactions, customers can enjoy a seamless experience.

Detailed customer insights:

With a 360-degree view, agents can access customers’ histories and preferences in a comprehensive manner across different channels. Accordingly, they can provide personalized services based on detailed customer data. This further helps in enhancing customer satisfaction and loyalty.

Effective Workflow Management:

A contact center software comes equipped with numerous automation tools. These tools are designed to automate various repetitive tasks, such as routing inquiries to the right agent or department, resulting in a reduction in wait times. Moreover, the advanced analytics and reporting features allow for optimization of workforce management and forecasting demand, ensuring that the right number of agents are available at the right time.

Enhanced Agent Performance:

With integrated training modules and knowledge bases available with the software, contact center agents can easily and quickly find the information they need to assist customers effectively. Besides performance monitoring tools like quality analysis and IVR & agent survey, management can provide timely feedback and coaching opportunities to agents to help improve their skills and overall efficiency.

Integration with CRM and Other Business Tools:

Contact center software can be integrated with the CRM system and other key business tools to ensure that all customer data is synchronized and up-to-date. This integration allows contact centers to get a unified view of customer interactions across all touchpoints. It further leads to a more strategic and informed omnichannel approach to customer service.

Scalability and Flexibility:

Modern contact center software is designed with scalability factors in mind. It means that these can be scaled as per the growth of the business and adapt to changing customer needs and technological advancements. Many organizations now also provide cloud-based contact center software deployment, allowing more flexibility in terms of access, updates, and integration with business tools.

All the above-mentioned reasons are enough to describe that businesses leveraging advanced contact center software can enhance customer satisfaction by implementing robust omnichannel strategies.

Key Features of Omnichannel Contact Center Software for BFSI

If you are looking for an omnichannel contact center software for the Banking, Financial Services, and Insurance (BFSI) sector, then make sure that it meets your specific needs and ensures security and excellent customer service. Here are some of the key features that one must look for in an omnichannel contact center software for the BFSI industry.

Omnichannel Communication Capabilities

Omnichannel contact center software supports various communication channels including voice, video, email, SMS, chat, social media, and mobile apps, providing customers with multiple options to connect with the customer service team. Besides, it allows customers to switch to another channel during an interaction without losing the context of the conversation.

Security and Compliance

Industries like BFSI need robust security and compliance features to ensure the complete protection of sensitive customer information during transmission and storage. The contact center software must adhere to industry and other local compliance requirements. Moreover, it must be equipped with various security features like SSO (Single Sign-On), 2FA (2 Factor Authorization), and more.

Real-Time Analytics and Reporting

Contact center software must contain real-time analytics and reporting features, allowing contact centers to gain insights into key call center performance metrics including response times, FCR rates, and customer satisfaction scores. With the help of detailed insights, contact centers can easily determine the areas of improvement, enabling more personalized and effective interactions along with continuous enhancement of omnichannel strategies.

Seamless Integration with Core BFSI Systems

Contact center software must be capable of integrating with the BFSI CRM system and other business tools so that agents can have access to up-to-date customer information and interaction history. The seamless integration of contact center software with core banking and insurance platforms helps agents get information like account details, transaction histories, policy information, and other details quickly. This consolidated information enhances efficiency and reduces the need for multiple logins.

Customer Experience Management

As mentioned above, when agents have access to comprehensive customer details, they can offer personalized service and tailor recommendations based on individual needs. It is also important that the software is capable of offering self-service options like multi-level IVR and Chatbot.

When customers are given self-service options, it leads to quick resolution of common customer queries. Moreover, the software must have built-in tools for collecting customer feedback and conducting surveys. This helps in identifying areas for improvement and enhancing customer satisfaction.

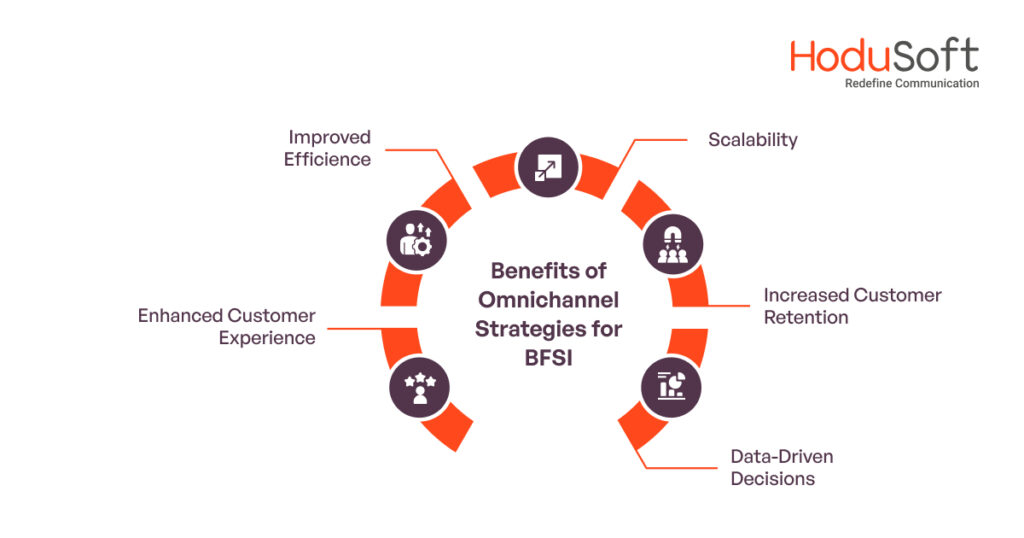

Benefits of Omnichannel Strategies with Contact Center Software

Implementing omnichannel strategies with contact center software offers a multitude of benefits for businesses. Some of the key benefits include-

Enhanced Customer Experience: When customers are offered consistent and personalized experiences across channels, the satisfaction rate is likely to increase.

Improved Efficiency: Using advanced tools and techniques offered by contact center software like speech analytics, text-to-speech, skills-based routing, and more, contact centers can not only streamline operations but also reduce response times.

Increased Customer Retention: You must be aware that customer retention costs significantly less than acquiring new customers. Omnichannel software helps build stronger relationships and loyalty through effective engagement.

Data-Driven Decisions: With tools like real-time analytics and reporting, quality analysis, and other advanced tools, businesses can easily make informed business decisions and enhance their customer service experiences.

Scalability: Today’s businesses need scalable solutions for seamless transformation. Most contact center software are designed to adapt to growing business needs and customer demands.

How omnichannel creates seamless customer service experience

How to Implementing Omnichannel Strategies in BFSI

Here are some of the key tips for implement omnichannel strategies in the BFSI sector-

Evaluate Current Business System:

Before designing any omnichannel strategy, it is important to evaluate your existing communication systems to determine their capabilities and limitations. By identifying gaps or areas for improvement, BFSI contact centers can plan a well-thought strategy to support an omnichannel approach. Additionally, collecting feedback from customers and staff can also be an effective step to get insights into areas needing improvement.

Technology Selection:

Choosing the right contact center software is essential for the successful implementation of an omnichannel strategy. Look for a contact center solution that comes equipped with multi-channel support, robust security and compliance features, seamless integration capabilities, advanced analytics tools, and various other advanced features.

Make sure that the software you choose must align with your business goals, be scalable to grow with your needs, and be flexible enough to adapt to changing customer preferences.

Easy Integration:

Integrating new contact center software with existing business systems can be challenging for businesses in the BFSI sector. It needs careful planning and execution. Make sure that the new software interfaces seamlessly with your CRM, core banking or financial system, and other essential platforms.

It is advisable to test the integration process thoroughly before going live to ensure data flows smoothly between systems and there are no disruptions to customer interactions or internal workflows.

Training and Development:

After implementing the software, it is essential to provide all the required training to staff to help them understand and adopt new contact center tools and omnichannel practices. This can be achieved by creating a comprehensive training program that covers all aspects of the new system, from basic functionalities to advanced features.

Additionally, it is vital to develop a culture of continuous learning and development by providing ongoing support and resources. Empowering agents with the necessary skills and knowledge will help them in providing consistent, high-quality service across all channels.

Monitoring and Optimization:

To maintain an effective omnichannel approach, it is important to monitor performance and optimize strategies. Contact center software tools like advanced analytics and reporting can be used to track and measure key performance indicators (KPIs), customer satisfaction, and agent productivity.

Besides, regular monitoring of data helps in identifying trends, areas for improvement, and innovation opportunities. Implementing refined processes and strategies will help ensure your omnichannel efforts remain aligned with business objectives and customer needs.

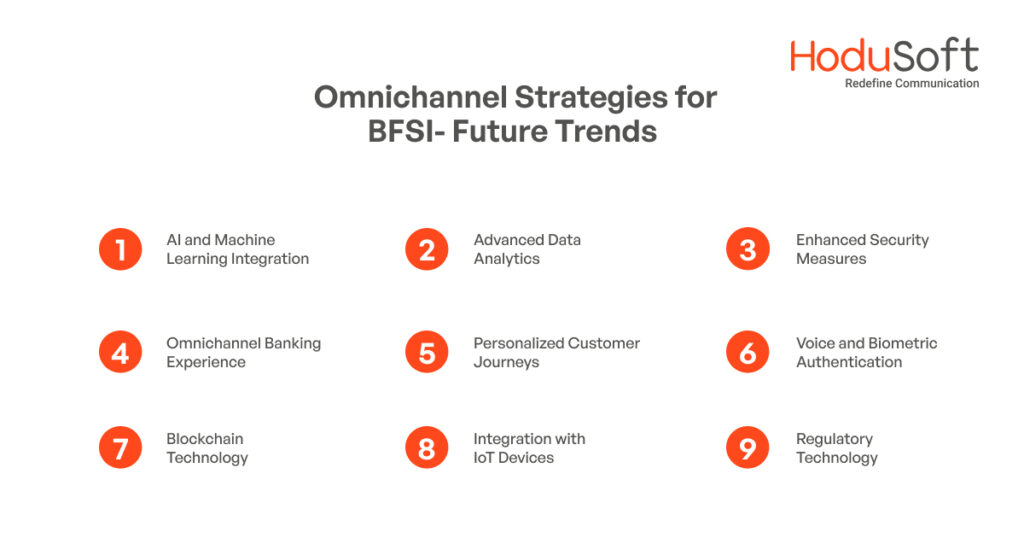

Future Trends in Omnichannel Strategies for BFSI

The future of omnichannel strategies in the BFSI sector is likely to be shaped by several emerging trends that focus on enhancing customer experience, leveraging advanced technologies, and ensuring robust security. Here are some key trends in omnichannel strategies for BFSI:

AI and Machine Learning Integration- Technologies like AI-powered chatbots and virtual assistants in the BFSI sector will become more sophisticated, handling a wider range of customer queries and transactions, thus enhancing the efficiency and responsiveness of customer service.

Advanced Data Analytics- The use of advanced data analytics will become more prevalent, allowing BFSI companies to gain deeper insights into customer behaviors and preferences.

Enhanced Security Measures- BFSI companies will invest in cutting-edge security technologies to safeguard their platforms and ensure compliance with stringent regulatory requirements.

Omnichannel Banking Experience- BFSI institutions will focus on integrating multiple channels more effectively, ensuring that customer information and transaction history are readily accessible across all platforms.

Personalized Customer Journeys- Personalization in terms of tailored financial advice, customized product offerings, and proactive customer support will not only enhance customer satisfaction but also drive customer loyalty and long-term engagement.

Voice and Biometric Authentication- Voice and biometric authentication technology will provide a more secure and convenient way for customers to access their accounts and perform transactions.

Blockchain Technology- Blockchain technology will be an important component of BFSI omnichannel strategies to provide transparent, secure, and immutable records. It can also enhance various aspects of BFSI operations, including transaction processing, identity verification, and compliance management.

Integration with IoT Devices- IoT integration will enable BFSI companies to offer more innovative and convenient services, enhancing the overall customer experience.

Regulatory Technology- To navigate complex regulatory environments in BFSI institutions, Regulatory Technology solutions will become increasingly important.

By staying up-to-date with these trends, BFSI institutions can enhance their omnichannel strategies, providing superior customer experiences and maintaining a competitive edge in the market.

Conclusion:

In today’s digital landscape, implementing a robust omnichannel strategy in the BFSI sector is no longer a luxury but a necessity. Carefully built and executed omnichannel strategies not only help in meeting growing customer expectations that demand seamless, personalized experiences across multiple channels but also drive operational efficiency and competitive advantage.

Embracing the strategies mentioned in this blog can help BFSI companies stay ahead of the curve, adapt to future trends, and build long-term, trust-based relationships with their customers.