Beat Long Wait Times & Misdirected Calls: Skill-Based Routing in Insurance

Just imagine yourself as a customer calling an insurance company for some work. After you’ve provided the inputs in the interactive voice response (IVR) system, the call goes to an agent who does not have the adequate skills and expertise to provide you with the solutions you are looking for. What would be your reaction?

It could range anywhere from distrust to frustration and irritation. If you look up the internet, you would be astonished to see how many customers lack trust in their insurance agents.

As per a study conducted by Accenture, just 27 percent of customers consider their insurance agents to be trustworthy. Another survey conducted by Deloitte revealed that only 11 percent of customers trust their insurance agents and brokers.

One of the best ways to enhance customers’ trust on their insurers as well as insurance agents and brokers is to make sure that they get to interact with agents with the most relevant skill sets and expertise whenever they call the customer care number of their insurance company.

Interestingly, there is a term for that and it is known as “skill-based routing” meaning that all incoming customers calls are routed to the agents with the right skills to address the queries and resolve the issues in the first instance of the contact.

At HoduSoft, we know what the right skill-based routing can do for an insurance company. Our high-quality and sophisticated contact center software solutions come equipped with cutting-edge skill-based routing feature that’s engineered to direct all incoming calls to the right agents and enhance first contact resolution (FCR) rate.

In this blog post, we have discussed everything about skill-based routing and how it helps contact centers agents in managing long wait times and misdirected inquiries in Insurance. Read on to know more.

- What is Skill-Based Routing?

- How Skill-Based Routing Work?

- Challenges Insurance Companies Face When They Don’t Use Skill-Based Routing

- Benefits Of Skill-Based Routing Over Traditional Routing

- Types Of Skill-Based Routing

- How To Implement Skill-Based Routing In Insurance Contact Centers

- Challenges And Considerations While Implementing Skill-Based Routing

What is Skill-Based Routing?

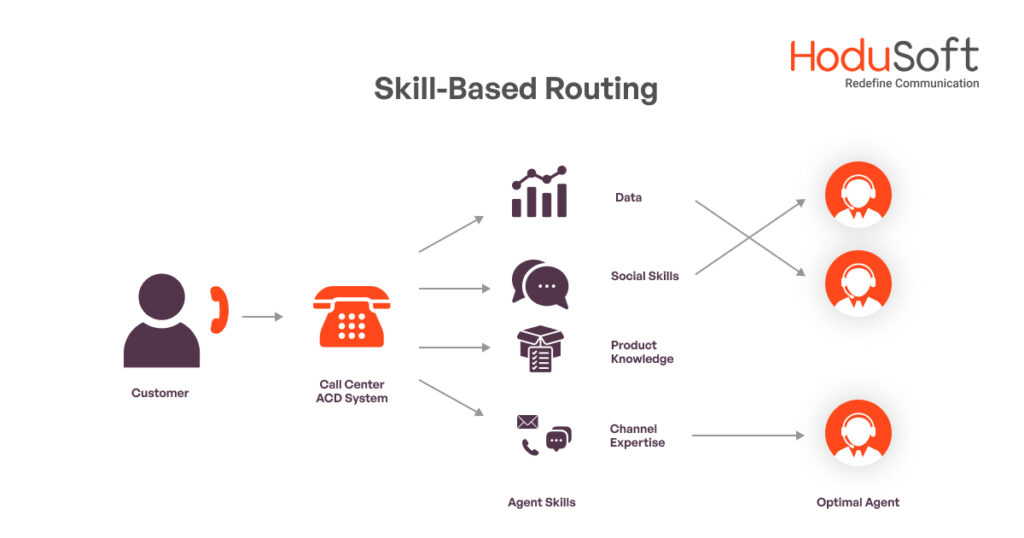

As the name suggests, skill-based routing is a strategy or a technique used by contact centers to connect customers with the most appropriate agent based on various factors such as skills, expertise, availability, and customer needs. .

Rather than simply routing calls to the next available agent, skill-based routing intelligently directs each call to the agent best equipped to handle the specific inquiry or issue at hand.

How Skill-Based Routing Work?

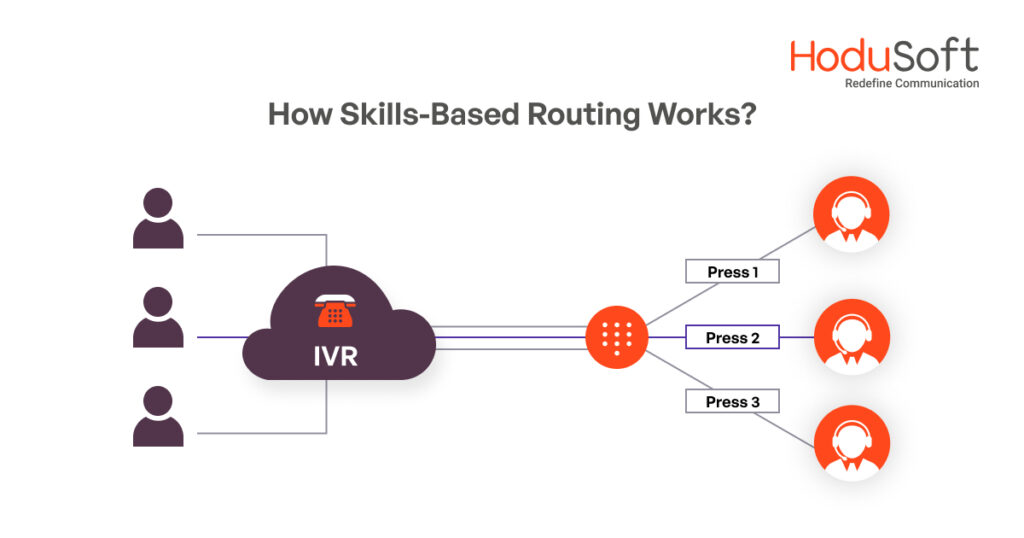

Skill-based routing works by getting customers’ input from the interactive voice response (IVR) system and matching their options and specifications to agents with the right language speaking and comprehension skills as well as technical skills.

For instance, if a customer dials a customer service number, then they will be greeted by an IVR system, which will ask them their preferred language options, the department they would like to speak with, the types of queries or issues they have, and so on.

Based on the customer’s inputs, the skill-based routing system will search for the agent with the right linguistic prowess, domain knowledge, technical ability and skills, and expertise to resolve the issue in just the first call itself.

After that, skill-based routing uses predefined rules and algorithms to match incoming calls with the most suitable agent based on a combination of factors such as:

- Skill Proficiency

- Agent Availability

- Customer Priority

- Routing Priorities Set By The Organization

These rules can be configured and adjusted to align with the organization’s business goals and service objectives.

Skill-based routing systems often include priority queuing capabilities to ensure that high-priority customers or urgent inquiries are promptly addressed. Calls are prioritized based on predefined criteria such as customer status, issue severity, or SLA (Service Level Agreement) requirements, allowing critical issues to be routed to the appropriate agents ahead of less urgent inquiries.

Understanding the Challenges in Traditional Call Routing

The insurance sector faces a lot of challenges in traditional call routing. Some of them are discussed here:

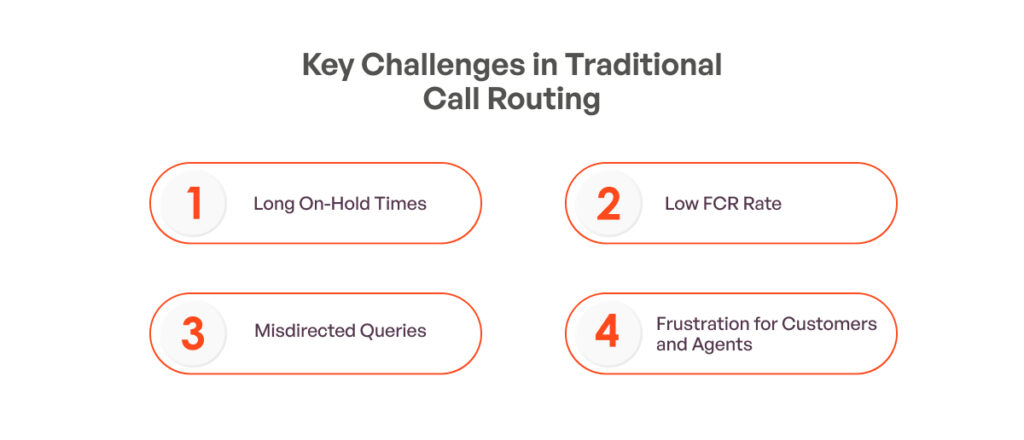

1. Long On-Hold Times

The insurance industry is struggling with reducing long on-hold times. In most cases, customers complain about poor communication with their insurance companies. Many of them said that they spend between 45 minutes to an hour on hold as they wait for the agents to pick up their calls. This is unacceptable. The insurance companies that don’t use proper skill-based routing struggle with long on-hold times.

2. Low FCR Rate

The next big problem many insurance companies face is the low first contact resolution (FCR) rate. Ideally, an organization’s FCR rate should be above 75 to 80 percent. That means if a hundred customers dial the company’s customer care number, then at least 75 to 80 of them should get their issues resolved and queries answered in the very first call itself. If that does not happen, it leads to dissatisfaction. Insurance companies that rely on traditional call routing processes have below-par FCR rates.

3. Misdirected Queries

In traditional call routing systems, the chances of customers’ queries getting routed to agents with appropriate expertise or knowledge is quite low. More often than not, quite the opposite happens. When a customer dials the number of an insurance company’s customer service department, then their calls get routed to an agent who has the right skills to address their queries.

4. Frustration for Customers and Agents

When customers are connected with the wrong agents, i.e. the agents who lack the necessary skills, expertise, and knowledge to provide effective customer service, then it increases frustration among customers and leads to discontent. Not just that. It also has an adverse impact on agents who have to deal with customers’ ire and find themselves at the receiving end of unpleasant situations. That not only leads to employee dissatisfaction but also causes burnout and high agent attrition rate.

How Contact Center Software Help Insurance Companies in Enhancing CX?

Benefits of Skill-Based Routing over Traditional Routing

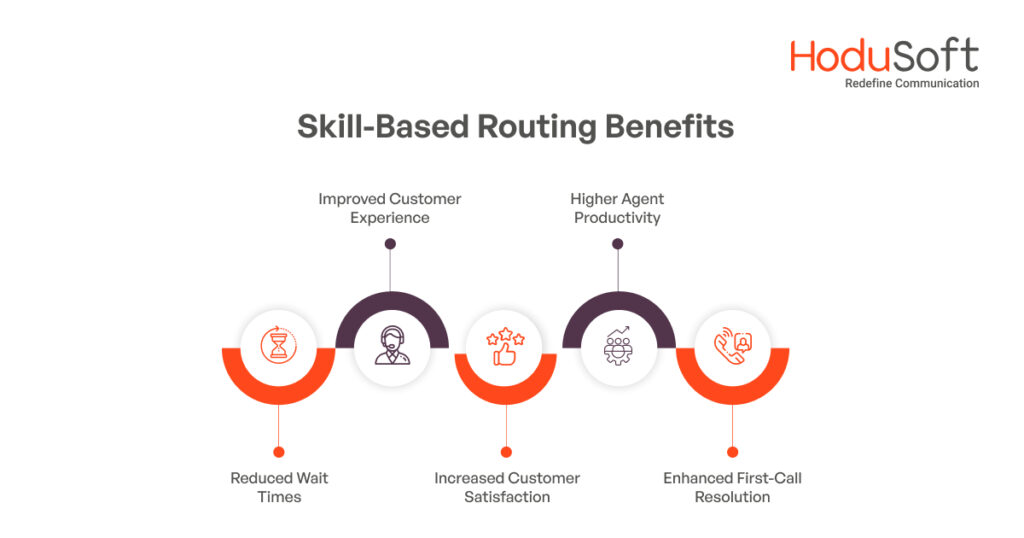

Skill-based routing offers a wide range of benefits over traditional routing. Some of those are:

1. Reduced Wait Times

This is the number one benefit of skill-based routing. Skill-based routing uses algorithms and advanced techniques to route all incoming calls to agents with the most appropriate skill sets and expertise. By doing so, it reduces wait times for customers and speeds up the calling process.

2. Improved Customer Experience

When customers are connected with the agents who have the right skills to address their queries or resolve their issues, it increases customer experience. Apart from resulting in faster issue resolution, it also leads to personalized interaction.

3. Increased Customer Satisfaction

This is a by-product of the above point. When customers receive better customer experience, they are more likely to be satisfied with their insurance company’s services. And it’s no secret that when customers get to speak to the right agent and get their issues resolved in the very first call, they are more likely to be happy.

4. Higher Agent Productivity

Just imagine a scenario where every agent gets calls as per their skills, expertise, and knowledge. There is no need for call backs, redirects, or transferring the call to supervisors or managers. What an ideal situation to be in! That’s precisely skill-based routing is all about.

5. Enhanced First-Call Resolution

When skill-based routing routes customer calls as per their inputs in the IVR to particular agents, it increases the likelihood of resolving inquiries on the very first call itself. It also eliminates the need for follow-ups and enhances efficiency for agents and customers.

Types of Skill-Based Routing

There are three main types of skill-based routing—standalone skill-based routing, omnichannel skill-based routing, and conversation priority skill-based routing. Let’s discuss each one individually.

1. Standalone Skill-Based Routing

As the name suggests, standalone skill-based routing refers to the method of routing calls, queries, or tickets based on agent skill and expertise. This begins by categorizing agents based on different skill groups such as:

- product knowledge

- language

- location

- experience

Standalone skill-based routing routes customer support tickets to the appropriate agent.

2. Omnichannel Skill-Based Routing

Omnichannel skill-based routing extends skill-based routing principles across multiple communication channels such as instant messaging apps, social media, email, live chats, SMS and text messages, video calls, and phone calls. When communication across various channels paired with agents’ availability, capacity, conversation priority, the result is magical!

3. Conversation Priority Skill-Based Routing

Conversation priority skill-based routing is a refined approach within skill-based routing systems that prioritizes ongoing conversations based on predefined criteria such as urgency, customer status, or issue complexity. It can also assess some more criteria such as language, interaction history, customer demographics, and more to ascertain if it must route a request to a department or an agent or not.

Apart from that, high-priority routing criteria usually include individuals with at-risk customers, high customer lifetime value (CLV), and customers who are dependent on relationships. Conversation priority skill-based routing ensures key conversations receive fast attention and resolution.

Implementing Skill-Based Routing in Insurance Call Centers

1. Assess Agent Skills and Expertise

First thing first, before you start implementing skill-based routing, evaluate the skills, expertise, and experience of every agent in your customer service team. Apart from assessing your agents’ core skills, make sure you assess their technical and soft skills.

After that, create a comprehensive profile of each agent and list their proficiency in various areas such as:

- Product Knowledge

- Language Proficiency

- Problem-Solving Abilities

- Critical Thinking Skills

- Communication Skills

2. Analyze Types of Queries or Issues to Develop a Mapping System

After you have assessed the skills and expertise of your agents, analyze the types of queries or issues customers commonly raise. Match these queries with the skills and expertise of your agents. This may involve:

- Categorizing Inquiries Based On Complexity

- Product Or Service Type

- Language Preference, Etc

Develop a mapping system that connects each type of inquiry to the agents best equipped to handle them.

3. Set up Routing Rules and Algorithms

As skill-based routing uses advanced algorithms and routing rules, it’s extremely essential to set up the right routing rules and algorithms. Setting up routing rules and algorithms may seem daunting at the beginning, but it’s quite easy after sometime.

To establish routing rules and algorithms and determine how incoming queries are routed to the most suitable agent based on predefined criteria. Consider various factors such as:

- Agent Availability

- Workload

- Skill Level Required For The Query

- And Other Relevant Parameters

Also, consider automating wherever possible to streamline the routing process and minimize manual intervention.

4. Testing and Refining the Skill-Based Routing System

Before deploying anything you must test it thoroughly to make sure that it’s effective and it works the way it is supposed to. The same thing goes for your skill-based routing system. Make sure that it’s effective and well-tested.

Before deploying the skill-based routing system, test several scenarios to make sure that the mock calls are appropriately routed to the right agents. During the testing phase, seek feedback relentlessly and identify all potential issues and areas for improvement.

After implementation, monitor system performance continuously and make necessary adjustments to optimize routing accuracy and efficiency. Update agent skill profiles and routing rules regularly to accommodate changes in agent capabilities or customer needs.

Challenges and Considerations in Implementing Skill-Based Routing

When it comes to challenges and considerations while implementing skill-based routing, keep the following things in mind.

1. Data Accuracy and Availability

As far as skill-based routing is concerned, data accuracy is everything. It can mean the difference between successful routing and unsuccessful routing of incoming calls.

As skill-based routing depends a lot on accurate and up-to-date data about agent skills and customer queries, ensuring the accuracy and availability of all crucial data is important. But it may be a bit challenging, considering how skills and queries tend to change frequently with time.

2. Complexity of Skill Mapping

Skill mapping is the process of assessing the skills possessed by employees in an organization. In the insurance industry, skill mapping is extremely important as it ensures that customer queries are efficiently directed to agents with the relevant expertise and knowledge to address them effectively.

It entails visual representation of employees’ skills and analyzing the skills necessary to perform a particular task, fill a certain role, complete a specific project, and round out a team. Mapping customers’ requests to agent skills can be a little challenging as it can be complex while doing it for skill-based routing.

3. Workload Distribution

Skill-based routing not only means that a customer’s call gets routed to the most appropriate agent but also it means all the even distribution of workload among agents based on their skills and expertise.

For instance, the workload in the underwriting department should be as evenly distributed as possible as the workload in the claims processing department. But when it comes to the real-life scenario, it can be quite a task to balance it evenly among agents especially while prioritizing high-priority or complex queries. That’s because some agents could be more experienced and skillful than others. And they may need to deal with a disproportionate amount of work.

4. Agent Training and Adaptation

In the insurance sector, proper training of agents is required for successful routing and resolution of incoming calls. When agents are trained properly, they are more likely to resolve customers’ queries and close the calls successfully. But sometimes, some training can put undue pressure on agents.

For instance, training for new workflows and responsibilities. When you implement skill-based routing it would need your agents to adapt to new workflows and responsibilities. Effective training and support is necessary to ensure understanding of agents on how the skill-based routing system works and how they can effectively handle queries assigned to them based on their skills.

In the End,

In the insurance sector, whenever an insurance company gets a call from a customer, they must make sure that the calls get routed to the right department and agent. If that doesn’t happen, it not only increases the likelihood of customer dissatisfaction but also poses a serious threat to its long-term profitability.

Skill-based routing is the beacon of efficiency and customer satisfaction in the insurance industry. By using advanced skill-based routing feature, insurance companies can reduce wait times and ensure that customers receive accurate and timely assistance. If you are looking for sophisticated skill-based routing feature in your contact center software, then we happen to have just the right solution for you.