From Lead Generation to Loan Approval: Why Microfinance Need a Unified Communication System

The microfinance industry is witnessing robust growth across the globe. A report released by PwC projects the global microfinance market to grow by USD 122.46 billion between 2021 and 2026, at a compound annual growth rate of 11.61 percent.

The growth is attributed to the rapid adoption of technology, particularly mobile and internet services. As microfinance institutions (MFIs) expand operations and customer bases, they need to maintain clear, consistent, and timely communication.

From generating leads to approving loans, every stage involves multiple touchpoints. And when communication is fragmented, it can significantly hinder efficiency, customer trust, and growth.

As MFIs scale their services and expand customer bases, many of them struggle to maintain consistent communication across departments and customer touchpoints. This is where the need for unified communication (UC) becomes extremely important. At HoduSoft, we have helped many MFIs with our sophisticated UC solutions and tools.

In this blog post, we’ll explore the challenges contemporary MFIs face due to fragmented communication, the basic concept of unified communication and the problems it solves, and the measurable value it offers.

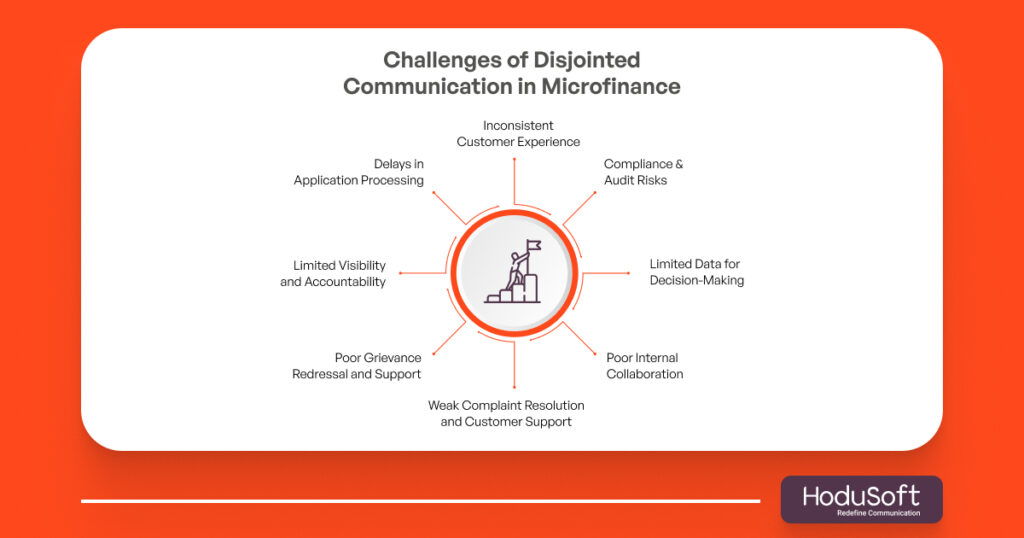

Key Challenges Microfinance Companies Face Due to Disjointed Communication

As discussed earlier, disjointed communication results in information siloes, which can be detrimental to any type and size of organization. It goes without saying that disjointed communication causes a lot of problems for microfinance companies. Here are some of those:

1. Inconsistent Customer Experience

The first and the major impact of disjointed communication is on the customer experience. Borrowers often interact with multiple touchpoints. Some of them are field officers, call centers, branch staff, and more. They may have to repeat their information every time they speak to a new agent or branch. Inconsistent updates on application progress or repayment schedules damage trust and reduce customer satisfaction. It also leads to confusion, repetitive conversations, and miscommunication.

2. Delays in Application Processing

When different teams (sales, verification, underwriting, etc.) use separate communication tools, the result is siloed communication. Which means loan officers are more likely to miss timely updates and misplace documents. Moreover, there are high chances that applicants may be contacted multiple times for the same request. All that leads to slower processing times and increased frustration for applicants.

3. Limited Visibility and Accountability

In microfinance visibility and accountability matters a lot. But when there’s no unified view of customer interactions, managers and agents struggle to track progress, assign tasks, or resolve issues efficiently. This lack of visibility reduces accountability and hinders collaboration between teams, which is especially problematic in rural branches where connectivity and infrastructure are already constrained.

4. Poor Grievance Redressal and Support

Let’s face it; if customer complaints don’t land with the right team or aren’t resolved quickly, things start to fall apart. This doesn’t just frustrate borrowers, it can also affect repayment behavior and weaken long-term trust in your institution. Without a unified system, issues can bounce between departments or get completely overlooked. Not just that, customer complaints may not reach the right team or get resolved on time.

5. Compliance and Audit Risks

When communication is all over the place, it’s easy to miss key details such as recording customer consent, tracking disclosures, or documenting interactions. These gaps can become serious problems during audits. With regulators paying closer attention to responsible lending and transparency, the risk of non-compliance only grows. Fragmented communication can result in undocumented interactions, missed disclosures, or unrecorded customer consent.

6. Poor Internal Collaboration

Without a unified communication system, departments struggle to share customer data or status updates in real time. This siloed approach severely affects coordination between field agents and back-office staff, especially in geographically dispersed or rural regions. The result is redundant efforts, missed follow-ups, and operational delays.

7. Weak Complaint Resolution and Customer Support

When customer interactions are not centrally tracked, grievances often slip through the cracks. A lack of a unified view across support channels leads to slow response times, repeated queries, and unresolved issues. Over time, this erodes customer trust, damages brand reputation, and weakens borrower loyalty.

8. Limited Data for Decision-Making

Disjointed communication channels create fragmented datasets, making it difficult to track borrower behavior, monitor campaign performance, or evaluate agent productivity. This lack of actionable insights undermines strategic planning, including decisions around lending models, credit risk assessment, and customer engagement strategies.

What Is a Unified Communication System?

As the name suggests, a unified communication system is a centralized platform that integrates multiple communication channels—such as voice, SMS, email, chat, and video—into one cohesive interface to streamline and manage all interactions efficiently.

The introduction and mass availability of UC systems have proved to be a boon for a wide range of industries, including the microfinance sector. A report published by Introspective Market Research projected the global UC market size to grow at a Compound Annual Growth Rate of 17.8 percent from USD 136.2 billion in 2023 to USD 595.1 billion by 2032.

As per the report the growth is driven by factors such as increased adoption of remote and hybrid work, advancements in technology, and the rising focus on customer experience.

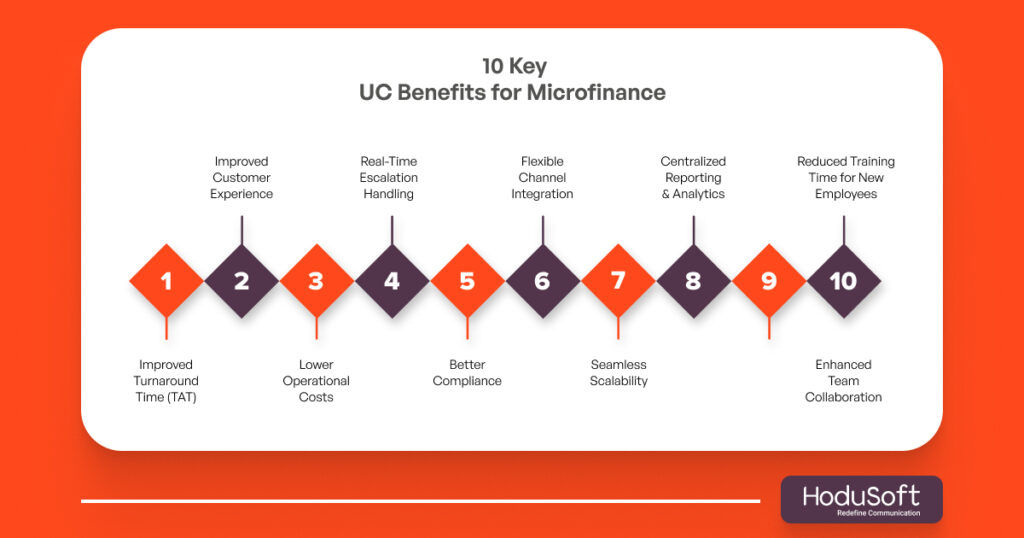

Benefits of UC Systems for Microfinance Institutions

A reliable Unified Communication (UC) system is not just any other upgrade, it’s a powerful internal operations enabler. By streamlining communication and data sharing across teams, it enhances productivity, transparency, and scalability. Here are some benefits of UC systems for MFIs:

1. Improved Turnaround Time (TAT)

The UC systems in microfinance isn’t just about better messaging. It speeds things up across the board. Integrated workflows mean teams aren’t stuck chasing emails or waiting for updates. No more back-and-forth between field and back office. Everything moves faster, from loan applications to disbursals. Doing so improves turnaround time (TAT).

2. Lower Operational Costs

Let’s be honest—manual work eats up time and money. By leveraging the right UC solution, you can automate repetitive tasks like sending payment reminders or updating loan statuses. That means fewer calls, fewer agents needed for basic queries, and more room in your budget for high-value work.

3. Centralized Reporting and Analytics

When all your communication data lives in one place, reporting gets a whole lot easier. Managers can quickly see how campaigns are performing, track customer satisfaction, or identify which agents are excelling. You don’t need multiple spreadsheets or late-night number crunching. Just click and go.

4. Better Compliance

In the world of microfinance, compliance isn’t optional. It’s critical. A UC system helps you stay on the right side of regulations by automatically recording and archiving every interaction. Whether it’s a WhatsApp message or a voice call, everything’s documented and audit-ready.

5. Seamless Scalability

Growth is exciting but also messy if your systems aren’t ready. With a UC system, you can add new branches, serve more customers, and launch new products without adding chaos. The communication stays smooth and consistent, no matter how big you get.

6. Enhanced Team Collaboration

When everyone can see the same customer data and interaction history, collaboration just happens. Field agents aren’t duplicating what the call center already did. Support staff aren’t blind to what sales promised. Everyone’s aligned and it shows in the results.

7. Improved Customer Experience

Customers hate repeating themselves. A UC system makes sure they don’t have to. Whether someone reaches out via call, SMS, or chat, the system remembers and continues the conversation smoothly. That kind of consistency builds trust and loyal borrowers.

8. Real-Time Escalation Handling

Problems don’t wait and neither should your team. A good UC system can automatically flag issues or delays and route them to the right person immediately. That means faster resolutions and fewer fires to put out later.

9. Flexible Channel Integration

Some customers love WhatsApp. Others still prefer phone calls. Whether your customers prefer WhatsApp, SMS, phone calls, or in-person interactions, a UC enables you meet customers where they are, without forcing them (or your team) to juggle different apps or devices. The flexible channel integration ensures inclusivity and broader reach.

10. Reduced Training Time for New Employees

Training new hires can be time-consuming, unless everything they need is already in one place. With a unified communication system, your staff learns one system, not five. That shortens onboarding, boosts confidence, and gets them helping customers faster.

Top 7 Tips for Reducing Wait Times in Microfinance

Unified Communication Best Practices for Microfinance Institutions

Those MFIs looking to leverage UC systems and tools must know and implement the best practices. Here are some of those:

1. Choose an Omnichannel Platform

First thing first, make sure you handpick a UC system that supports all major channels such as voice, SMS, WhatsApp, email, and in-app chat. This ensures customers can reach you through their preferred method, and your teams can respond without switching between tools.

2. Centralize Customer Data and History

After selecting the right omnichannel platform, integrate all communication records into a single CRM or customer management system. This enables staff to access full interaction histories, improving service quality and reducing repetition for customers.

3. Automate Routine Communication

Set up automated workflows for the routine stuff. It saves time, reduces manual workload as well as errors, and keeps customers in the loop. Consider setting up automated workflows for application status updates, payment reminders, due diligence follow-ups, and grievance acknowledgments.

4. Ensure Real-Time Synchronization Between Teams

Make sure that field agents, branch staff, and back-office teams are all working on the same system with real-time updates. This avoids duplication, speeds up decision-making, and improves field coordination especially in rural deployments.

5. Set Role-Based Access and Permissions

Not every employee needs access to every piece of customer data. Implement role-based access to maintain data privacy, protect sensitive information, and stay compliant with data protection regulations.

6. Monitor Communication Metrics Regularly

Track KPIs like average response time, complaint resolution rate, missed calls, and channel usage. Use these insights to fine-tune your support strategy and identify training needs.

7. Train Staff Continuously

Equip teams with regular training on using the UC system effectively—including new features, compliance rules, and best practices in customer communication. This reduces errors and boosts adoption.

8. Integrate UC with Loan Management Systems

Seamless integration with your core lending software ensures communication flows align with the loan lifecycle—from lead capture to final repayment. It also ensures that critical updates (e.g., loan disbursement or overdue notices) are sent automatically.

9. Build Escalation Paths into the System

Use automation to flag and escalate unresolved issues or high-risk interactions (e.g., fraud suspicion, repeat complaints) to supervisors or compliance teams quickly.

10. Regularly Audit Communication Logs

Ensure periodic reviews of communication logs for compliance, quality assurance, and fraud prevention. Documented interactions can be critical during audits or in dispute resolution.

All In All,

At the end of the day, communication is the backbone of microfinance. It’s what keeps everything running smoothly, from the very first lead to the final loan repayment. But when your systems are scattered, things slip through the cracks: delays happen, customers get frustrated, and teams struggle to stay aligned.

That’s where a Unified Communication system really shines. It pulls everything together, whether it’s calls, chats, emails, WhatsApp messages, into one place so your team can work smarter, faster, and more efficiently. It also means your borrowers get timely updates, better support, and a more consistent experience, no matter where they are.

At HoduSoft, we have served many MFIs and tailored our suite of UC systems for all sizes of organizations. So if your microfinance operations are growing (or plan to), it’s time to stop patching things together and start thinking long-term. A solid UC system isn’t just a nice-to-have, it’s a must-have for microfinance companies.