Insurance Customer Retention with Contact Center Software

For contemporary insurance companies, acquiring more policyholders is not good enough. Retaining them over a long period of time is critical to success.

The insurance sector has become intensely competitive more than ever before. The cost of acquiring new clients continues to increase. In such a scenario, customer retention (or retention of policyholders, if you will) is the only recourse.

Insurance companies are doing whatever it takes to retain more policyholders, including leveraging sophisticated technology solutions such as AI-powered contact center software.

This blog explores the importance of customer retention in the insurance sector, some common customer retention challenges, the functionality of contact center software, and how it contributes to enhancing customer satisfaction, reducing churn, and building long-term customer loyalty.

- Why Customer Retention is Critical in Insurance?

- Challenges Insurance Companies Face in Retaining Customers

- How Can Contact Center Software Help Insurance Companies Retain Customers?

- Benefits of Higher Customer Retention for Insurance Companies

- Key Features of Effective Insurance Call Center Software

- Best Practices for Implementing Contact Center Solutions in the Insurance Sector

- Conclusion

Why Customer Retention is Critical in Insurance?

Customer retention is critical for the survival of every business across sectors. How can the insurance industry be any different?

Depending on which study you believe in, acquiring new customers costs five to seven times more than retaining existing ones.

In the insurance sector, the long-term value policyholders bring through renewals, referrals, and opportunities for cross selling insurance products makes customer retention all the more important.

If a policyholder doesn’t feel valued or receives poor customer service, they’re more likely to switch to a competitor promising better deals or faster customer service operations.

Challenges Insurance Companies Face in Retaining Customers

Insurance companies face a wide range of unique challenges in retaining customers due to many factors. Let’s discuss some of those:

1. Limited Engagement Opportunities

The communication shouldn’t end just after a policy is sold. Nor should it resume if there’s a new claim or renewal request. It should be ongoing. However, a lot of insurance companies struggle to maintain regular customer interactions.

2. Poor Customer Service Experiences

Long wait times, inefficient call center operations, and unresolved customer concerns contribute to poor customer service. A single negative experience with an insurance company can affect customer loyalty.

3. Lack of Personalization

Customers expect tailored services based on their needs and past interactions. The insurance companies that don’t have integrated CRM systems, struggle to provide personalized service. The lack of personalized service opens the door for competitors.

4. Complicated Claims Processing

Gone are those days when a majority of customers didn’t mind bearing with slow and complicated claims processing. In today’s time, all customers want fast and simple service. If the claims processing is slow and confusing, it affects customer satisfaction.

5. Inadequate Use of Technology

Some insurance agencies still rely on outdated systems. It’s similar to participating in a Formula One race with an old jalopy. Without sophisticated technology, insurers will struggle to deliver consistent service quality.

6. Rising Competition and Price Sensitivity

The insurance sector is increasingly price-sensitive. Customers often compare policies online. If insurers don’t offer value-added services or personalized customer service, price becomes the only differentiator. That’s when policyholders start to leave in hordes.

7. Data Security Concerns

A breach or misuse of customer data can lead to severe reputational damage and customer churn. As customers become more aware of digital risks, they demand more security. They look for trustworthy service providers that can guarantee data security. Those who can’t will lose policyholders.

8. Ineffective Feedback Loops

Feedback is the breakfast for champions. Without it there is no progress. If the customer feedback loop is ineffective, then it becomes difficult for insurance companies to retain customers. They miss opportunities to improve customer service operations and enhance customer satisfaction. They must have mechanisms to gather and act on customer feedback.

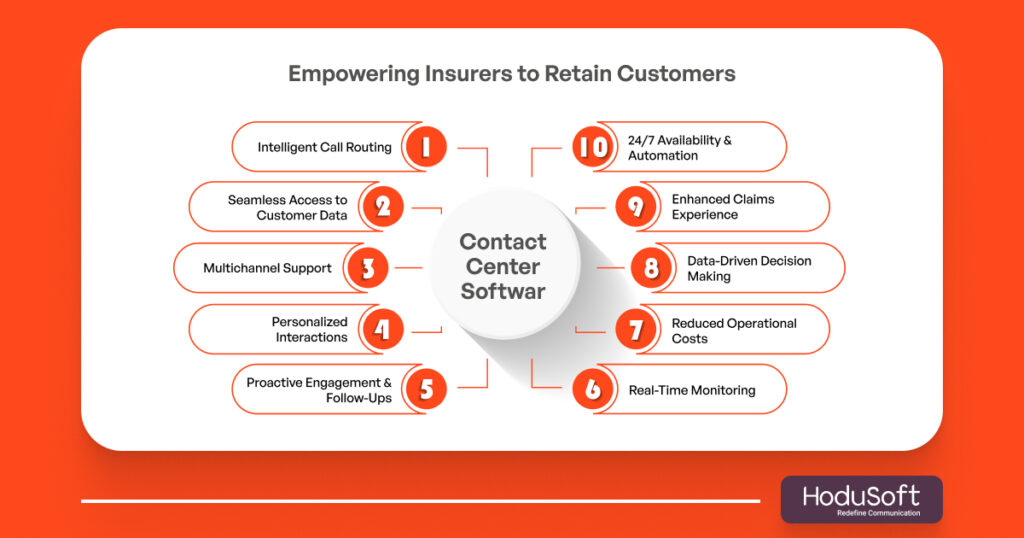

How Can Contact Center Software Help Insurance Companies Retain Customers?

In a highly competitive insurance industry, customer retention hinges on delivering a seamless, responsive, and personalized customer experience. Contact center software serves as a strategic tool to achieve this by streamlining operations, improving customer interactions, and supporting long-term engagement. Here’s how it empowers insurance companies to retain customers:

1. Intelligent Call Routing for Faster Resolutions

One of the biggest frustrations for policyholders is being transferred multiple times before speaking to the right person. Contact center software uses intelligent call routing to ensure that customer inquiries are directed to the most qualified center agents, resulting in quicker issue resolution and improved customer satisfaction.

2. Seamless Access to Key Customer Data

Integrated CRM systems within insurance call center software give agents real-time access to customer data, including policy details, purchase history, and previous interactions. This enables personalized customer service and helps resolve issues faster, building trust and loyalty.

3. Enhanced Multichannel Support

Modern contact centers operate across multiple channels—voice, email, chat, and social media—allowing policyholders to interact in the way they prefer. Offering consistent service across all platforms not only enhances customer experience but also increases customer satisfaction and retention.

4. Personalized Interactions That Build Loyalty

Contact center solutions help agents deliver tailored services by leveraging analytics and AI. Personalized support during renewals, claims processing, or policy inquiries shows customers they’re valued, encouraging long-term loyalty.

5. Proactive Engagement and Follow-Ups

Contact center software automates follow up calls, renewal reminders, and claim updates—ensuring policyholders feel supported throughout their insurance journey. These proactive customer interactions significantly enhance overall customer satisfaction and reduce churn.

6. Real-Time Monitoring and Agent Coaching

Supervisors can monitor agent performance and customer service operations in real time. This allows them to identify training gaps, boost agent efficiency, and ensure a consistently high level of service quality across the insurance call center.

7. Reduced Operational Costs and Improved Efficiency

By automating repetitive tasks such as data entry and claims updates, call center software reduces workload and improves operational efficiency. This not only lowers costs but also frees up agents to focus on resolving more complex customer concerns.

8. Data-Driven Decision Making

Contact center solutions collect valuable insights from customer behavior and interactions. Insurance companies can use this data to identify at-risk customers, refine engagement strategies, and design targeted retention campaigns.

9. Enhanced Claims Experience

Fast, transparent claims processing is crucial for customer retention. Contact center software ensures smooth coordination across departments, timely responses to claims-related queries, and real-time status updates, contributing to higher client retention.

10. 24/7 Availability and Automation

AI-driven chatbots and self-service portals ensure that customers can get help anytime—without waiting for business hours. This boosts customer satisfaction while keeping service levels high even during peak periods.

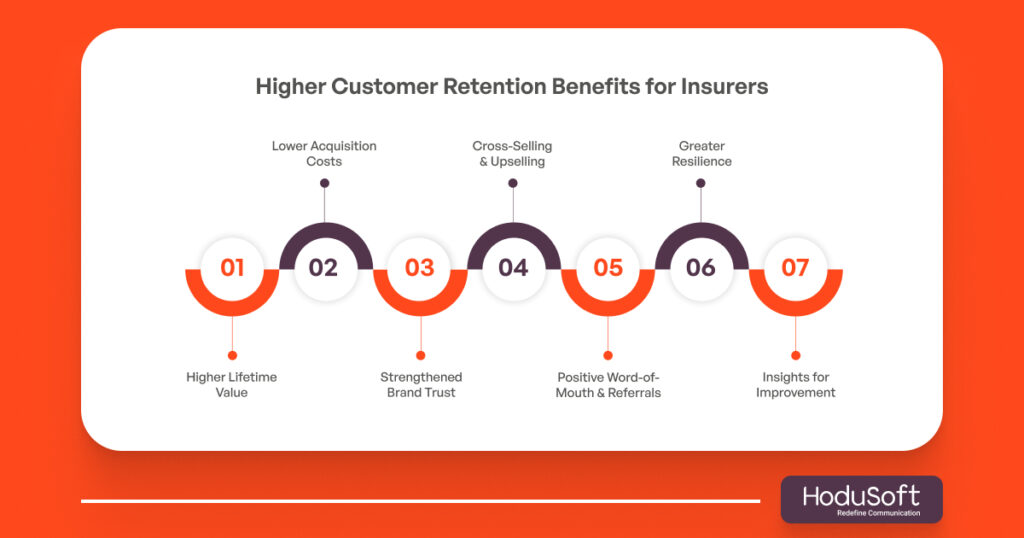

Benefits of Higher Customer Retention for Insurance Companies

Customer retention is a critical success factor in the insurance industry, where long-term relationships often yield more value than one-time sales. Here’s why retaining customers should be a top priority for insurance companies:

1. Higher Lifetime Value

Long-term policyholders contribute significantly to revenue through policy renewals, premium upgrades, and cross selling insurance products. A loyal customer is more likely to purchase additional insurance services over time, increasing overall profitability.

2. Lower Acquisition Costs

Acquiring new customers in the insurance sector can be expensive due to marketing, sales, and onboarding costs. Retaining existing customers is far more cost-effective and delivers better return on investment in the long run.

3. Strengthened Brand Trust

Consistently delivering exceptional customer service builds credibility. When customers feel valued and receive reliable service, they are more likely to view their provider as a trustworthy service provider, which reinforces long-term loyalty.

4. Better Opportunities for Cross-Selling and Upselling

Satisfied, long-term customers are more open to exploring new products. With access to customer data and purchase history through integrated CRM systems, agents can offer tailored services that match evolving needs.

5. Positive Word-of-Mouth and Referrals

Happy customers often recommend their insurance providers to friends and family. This organic promotion not only brings in prospective clients but also strengthens your company’s reputation in a highly competitive insurance market.

6. Greater Resilience During Market Shifts

When market conditions change—due to economic downturns or regulatory updates—companies with a loyal customer base are more likely to remain stable. Strong customer relationships act as a buffer against external disruptions.

7. Insights for Business Improvement

Long-standing customer relationships provide valuable feedback that can be used to enhance customer experience, improve contact center solutions, and fine-tune claims processing workflows.

Top Call Routing Strategies to Improve Customer Experience

Key Features of Effective Insurance Call Center Software

For insurance companies aiming to boost customer retention, the right contact center software is more than just a communication tool—it’s a central hub for managing customer interactions, optimizing service delivery, and building long-term relationships. Here are some essential features that make insurance call center software truly effective:

1. AI and CRM Systems Integration

Integrating AI and CRM systems enables call center agents to access key customer data instantly, including policy information, previous customer interactions, and claims history.

AI enhances customer service operations by offering smart suggestions, automating routine tasks, and supporting intelligent call routing. Together, they provide personalized customer service, streamline workflows, and improve decision-making.

2. Agent Productivity Tools and Performance Dashboards

Contact center software should include tools that help monitor agent performance and improve agent productivity. Dashboards offer real-time insights into service quality, call resolution times, and customer satisfaction metrics.

This transparency allows supervisors to coach agents more effectively, address performance gaps, and ensure consistent service delivery across the insurance call center.

3. Self-Service Portals and Automated FAQs

Modern contact center solutions empower customers through self-service options. Automated FAQs and customer portals allow policyholders to access information, update personal details, or track claims without waiting for an agent.

These tools not only reduce call volumes but also increase customer satisfaction by offering convenience and timely responses.

4. Customizable Reporting and Analytics

Analytics and reporting are critical for understanding customer behavior, tracking the customer retention rate, and identifying service bottlenecks.

Insurance agencies can use these insights to improve contact center strategies, develop targeted campaigns, and measure the effectiveness of their customer service department.

5. Omnichannel Support for Improved Customer Satisfaction

Today’s customers expect service across multiple channels—phone, email, live chat, and social media. Effective insurance call center software supports seamless communication across all platforms.

This ensures a unified customer experience, allowing policyholders to engage in their preferred channel without compromising service quality. Omnichannel support plays a vital role in enhancing customer satisfaction and loyalty.

6. Workflow Automation for Claims and Follow-Ups

Efficient claims processing is vital in the insurance industry. Contact center software with automation capabilities can streamline repetitive tasks such as data entry, status updates, and follow up calls.

Automated workflows ensure timely responses and consistent handling of customer inquiries, which enhances overall customer satisfaction and improves operational efficiency.

7. Data Security and Compliance Management

Handling sensitive customer data requires robust security features. Advanced insurance call center software includes data encryption, secure storage, and compliance tools to meet industry regulations.

Ensuring data security not only protects the organization but also strengthens trust with policyholders—positioning the insurer as a reliable service provider.

Best Practices for Implementing Contact Center Solutions in the Insurance Sector

Implementing contact center software is not just about technology—it’s about creating a service-driven culture that puts the customer first. For insurance companies to fully benefit from their investment in contact center solutions, the following best practices are essential:

1. Choosing the Right Contact Center Software Vendor

Selecting a vendor with experience in the insurance sector ensures the software meets industry-specific needs like claims processing, policy management, and compliance.

Look for scalable, cloud-based platforms that offer robust features such as intelligent call routing, AI and CRM systems integration, and omnichannel support. A reliable vendor will also provide ongoing support and customization options.

2. Training Insurance Agents for Exceptional Customer Service

Technology is only as effective as the people using it. Insurance agents must be trained not just on the software but also in delivering exceptional customer service.

Training should focus on using tools for personalized customer service, resolving customer queries efficiently, and improving agent performance. Well-trained agents directly contribute to customer satisfaction and loyalty.

3. Regularly Updating CRM Systems and Customer Data

Accurate and up-to-date customer data is crucial for personalized interactions and successful customer relationship management.

Ensure your CRM systems are regularly updated to reflect changes in customer behavior, purchase history, and preferences. This enables agents to provide relevant solutions and build stronger customer relationships.

4. Monitoring Agent Performance and Customer Feedback

Continuous monitoring allows supervisors to track agent productivity, identify service gaps, and coach underperforming staff.

In parallel, collecting and analyzing customer feedback provides insights into service quality and the effectiveness of your insurance call center services. Together, these practices help in improving customer service and maintaining high satisfaction levels.

5. Aligning Contact Centers with Personalized Customer Service Goals

Your contact center strategy should align with broader customer experience objectives. Focus on delivering tailored services through intelligent call routing, AI support, and follow up calls.

This alignment ensures consistency across customer touchpoints and reinforces your brand’s reputation as a trustworthy service provider.

6. Leveraging Analytics to Drive Continuous Improvement

Use the analytics tools built into your contact center software to gain deep insights into customer interactions, service trends, and agent performance.

These data-driven insights help insurance providers identify opportunities for refining workflows, improving service quality, and increasing client retention. Regular reviews of performance metrics also support proactive decision-making and long-term strategic planning.

7. Ensuring Seamless Integration with Other Business Systems

For maximum efficiency, your contact center software should integrate smoothly with other core insurance platforms—such as claims management systems, policy databases, and billing applications.

Seamless integration reduces data entry duplication, enhances access to key customer data, and supports a unified customer experience across departments.

Summing Up,

As the insurance sector is evolving at a rapid pace due to technology breakthroughs and changing customer expectations, insurers must do whatever it takes to retain as much of their clients as possible.

One of the most effective ways to do that is by leveraging the right technology tools such as sophisticated contact center software.

At HoduSoft, we have helped several types and sizes of insurance companies in customer retention. We have engineered our HoduCC contact center software to resolve a maximum number of queries and issues on the very first instance of contact.