The Role of Call Center Automation in Scaling Lending

The microfinance sector is one of the most underrated sectors. Its main objective is to maximize financial inclusion. In simple words, to put money in the hands of people who need it the most. By doing that, it has empowered people in underserved communities.

However, when it comes to the way the sector operates, nothing has changed much over the decades. The reliance on traditional and manual methods is high, leading to repetitive tasks, inefficiencies, and micromanagement of processes.

The microfinance sector must be all about microloans and not micromanagement. That’s where call center automation comes into play.

It offers a smarter way to connect with borrowers, streamline loans, and maximize financial inclusion. As the legendary Bill Gates rightly said, “Automation applied to an efficient operation will magnify the efficiency.”

In this blog, we’ll explore the unique challenges of scaling microfinance lending and how call center automation can help institutions overcome them effectively.

Challenges Microfinance Companies Face

Microfinance companies operate in one of the most challenging financial sectors. Their goal, which is to serve the unbanked populations with small loan amounts, is noble but operationally intense. Several unique hurdles stand in the way of efficient scaling:

1. High Operational Costs

Out of all financial institutions, the microfinance sector is highly cost effective. But when it comes to administrative expenses, it’s quite high due to a wide customer base. Even though microloans involve small ticket sizes, managing them involves significant administrative expenses. Managing small loans often demands considerable manpower. That drives up operational costs.

2. Scalability Constraints

When it comes to expanding operations, microfinance companies find it a bit difficult to do that without increasing staff and infrastructure in the same proportion. It’s even difficult in remote areas. Expanding operations traditionally requires hiring more field staff and support teams. This is where scaling communication operations could be helpful.

3. Language Barriers

Microfinance companies deal with people who speak a variety of regional languages or dialects. This makes standardized communication difficult. Language barriers are extremely detrimental and can result in misunderstandings, missed repayments, and dissatisfaction

4. Low Literacy Levels

Many borrowers come from communities where literacy levels are low. Written communication, whether via SMS or printed documents, may not always be effective. Many of them don’t fully understand written communication such as SMS reminders, loan terms, or contracts. Voice-based engagement becomes critical but resource-heavy when handled manually.

5. Inconsistent Customer Support

Limited staff strength and lack of proper training often result in inconsistent communication with borrowers. Sometimes, agents provide conflicting information. That confuses clients and erodes their trust in the organization. Consistency in messaging is extremely critical for microfinance companies that are trying to build long-term relationships.

6. Delayed Responses

High call volumes, combined with manual processes, often lead to delayed responses. Clients who are looking for urgent support may end up frustrated when they don’t receive timely help. For microfinance companies, this delay can cause dissatisfaction and even impact repayment behaviors if concerns are not addressed promptly.

7. Lack of Personalized Communication

Microfinance customers expect a certain level of personalization, especially since their financial needs are often unique. Sending out generic or mass messages without considering the client’s history or situation makes them feel undervalued. Personalized communication can go a long way in building stronger borrower relationships and improving service satisfaction.

8. Difficulty in Reaching Remote Clients

Many microfinance clients live in areas with poor mobile network connectivity or limited access to smartphones. This makes it extremely difficult for companies to reach them consistently. Physical outreach increases operational costs, while digital communication remains unreliable, creating a major bottleneck for smooth interactions.

9.Miscommunication About Loan Terms

When loan terms and repayment schedules are not explained clearly, misunderstandings become inevitable. Borrowers may agree to terms they don’t fully grasp, leading to defaults or disputes later. Proper, simple, and repeated communication is essential to ensure that borrowers completely understand their obligations.

10. Fragmented Communication Channels

Microfinance companies often use a mix of calls, SMS, WhatsApp messages, and even field visits to connect with clients. However, when these channels are not integrated, important messages get lost, duplicated, or delayed. A fragmented communication approach leads to inefficiencies and increases the chances of errors.

11. Limited Feedback Mechanisms

In many cases, clients don’t have an easy way to report issues or share feedback about their experience. When grievances are not heard or addressed, it results in dissatisfaction and negative word-of-mouth. Establishing simple and accessible feedback systems is crucial for improving service quality.

12. Cultural Sensitivity Issues

Microfinance clients come from diverse cultural backgrounds, and communication that is not sensitive to local customs can easily offend or alienate them. Without proper cultural training, agents may unknowingly use language, tones, or messaging styles that are inappropriate. Cultural awareness must be a priority to maintain trust and credibility.

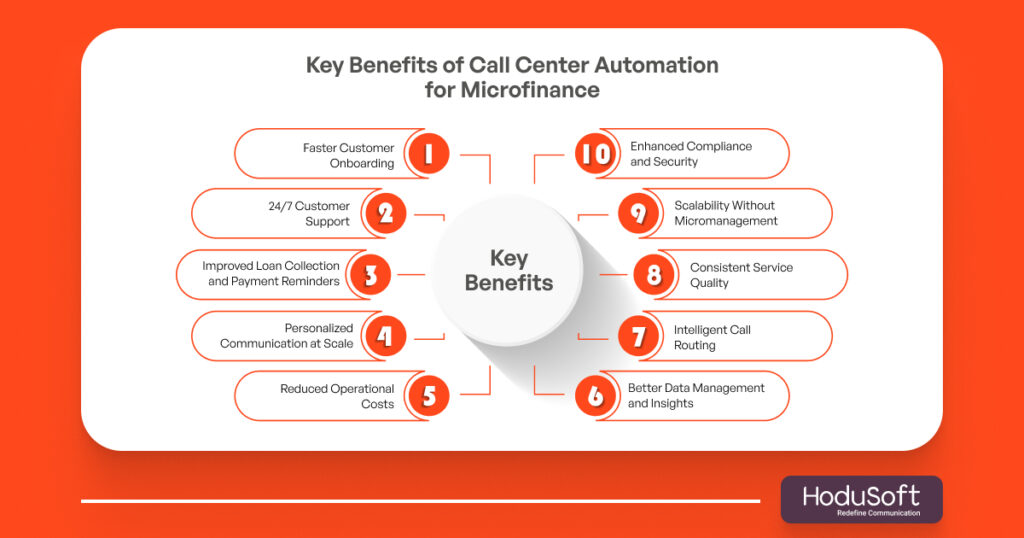

Key Benefits of Call Center Automation for Microfinance

Call center automation doesn’t just optimize existing processes—it completely transforms how microfinance institutions engage with borrowers. Here’s how it plays a pivotal role in scaling:

1. Faster Customer Onboarding

Call center automation makes onboarding new borrowers quicker and more efficient. Automated IVR systems and chatbots can collect essential documents, verify KYC details, and guide clients through the loan application process without needing human intervention at every step. This helps microfinance companies serve more clients without overwhelming their teams.

2. 24/7 Customer Support

Unlike traditional call centers that operate only during office hours, automated systems can support clients round the clock. Borrowers can get answers to common questions, check loan statuses, or request services anytime they want. This constant availability builds trust and improves the borrower experience significantly.

3. Improved Loan Collection and Payment Reminders

Automation enables microfinance companies to send timely payment reminders through calls, SMS, or WhatsApp messages. These reminders are consistent and personalized based on each borrower’s due dates. As a result, repayment rates improve and the number of defaults goes down without burdening human agents.

4. Personalized Communication at Scale

Even when dealing with thousands of customers, automation allows microfinance institutions to send personalized messages. Whether it’s loan approval updates, payment alerts, or service notifications, borrowers feel recognized and valued when communication feels tailored to them.

5. Reduced Operational Costs

Hiring and training call center agents for every stage of the customer journey is expensive. Automated systems can handle repetitive tasks like FAQs, appointment scheduling, and reminders, allowing human agents to focus only on complex queries. This brings down operational costs without sacrificing service quality.

6. Better Data Management and Insights

Automation platforms can track every interaction, store important borrower information, and generate reports. This helps microfinance companies monitor trends, understand borrower behavior, and make data-driven decisions to improve services and lending strategies.

7. Intelligent Call Routing

When a borrower needs specialized assistance, automated systems can route the call to the right department or agent based on predefined rules. This ensures that clients don’t have to explain their issues multiple times or get bounced between different people, improving customer satisfaction.

8. Consistent Service Quality

Human agents may sometimes have off days, but automated systems provide consistent service every time. Standardized scripts, response templates, and process flows ensure that all borrowers receive accurate, uniform information no matter when they call.

9. Scalability Without Micromanagement

As microfinance companies grow, manual customer service becomes harder to manage. Call center automation allows businesses to scale operations effortlessly, handling larger volumes of interactions without needing to hire and micromanage large teams.

10. Enhanced Compliance and Security

Automated systems can be programmed to follow regulatory guidelines during every interaction. From data privacy to audit trails, automation helps microfinance companies stay compliant while reducing the risk of human errors that could lead to penalties.

Top 7 Tips for Reducing Wait Times in Microfinance

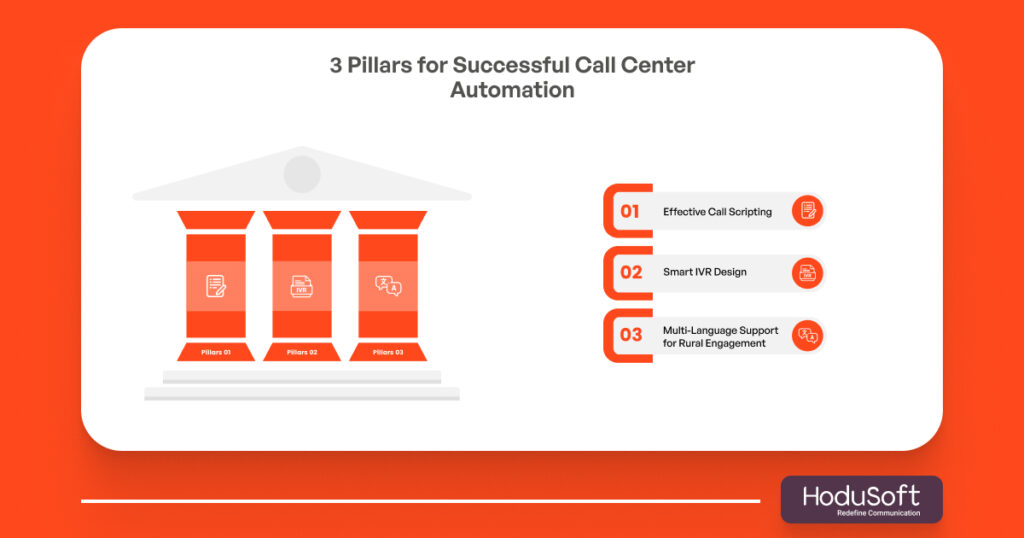

Pillars for Successful Call Center Automation

To truly unlock the power of automation in scaling lending, microfinance institutions must focus on these three critical pillars:

1. Effective Call Scripting

Scripts must be clear, friendly, and easy to understand, especially for borrowers who may be unfamiliar with financial jargon.

Scripts should cover key scenarios: loan application updates, repayment reminders, payment confirmations, grievance handling, and loan closure.

They should sound natural, not robotic, guiding both live agents and voicebots toward positive borrower experiences.

2. Smart IVR Design

An IVR system is often the borrower’s first interaction with the lender — it must be intuitive.

Simple, action-oriented options like “Press 1 for your next payment date,” “Press 2 for loan status,” and “Press 3 to connect with an agent” help borrowers navigate quickly without frustration.

Customizing IVR flows based on language, loan type, or account status can further enhance borrower engagement and reduce drop-offs.

3. Multi-Language Support for Rural Engagement

Supporting multiple languages—not just major ones such as English or French but regional dialects—is vital for connecting with rural borrowers.

Voicebots, IVR prompts, SMS reminders, and WhatsApp messages should all be localized, using simple words and culturally appropriate messaging to build trust and drive action.

How to Implement Call Center Automation in Microfinance

Scaling up customer service operations can be challenging for microfinance companies if they don’t have the right strategy to do that. Here is a step-by-step guide to implementing call center automation in microfinance operations:

1. Understand Your Current Process

Before considering automation, it’s critical to first understand your current processes. Where do borrowers experience long wait times? Repetitive queries? Miscommunication? Or dropped conversations? Differentiate high-value conversations needing human interaction from routine tasks needing automation.

2. Identify Automation Opportunities

After assessing your current process, identify automation opportunities. You have already identified tasks that need human intervention. You need to pinpoint the tasks that should be automated. Some of those tasks are payment reminders, FAQs, application updates, and grievance registration.

3. Choose the Right Tools and Platforms

Not all automation tools are equal. Some are more sophisticated and advanced than others. Microfinance companies must choose platforms that are multilingual, omnichannel, customizable and integrable. Most importantly, the solutions must be engineered for financial services.

4. Train Your Contact Center Agents

The next step is to train your agents on how automation helps them handle fewer repetitive tasks and focus on more complex tasks. When agents feel empowered by automation, adoption rates and borrower satisfaction increases.

5. Track Key KPIs

Implementing automation isn’t a one-time event. It’s an evolving process that needs close tracking. Track key performance indicators (KPIs) such as First Call Resolution (FCR), Average Handle Time (AHT), Automation Containment Rate, Call Abandonment Rate, Agent Satisfaction Scores, Customer Satisfaction (CSAT), and more.

6. Pilot Test Before Full Rollout

Start with a smaller borrower segment to test call flows, scripts, language support, and system reliability. Use feedback to fine-tune the system before a full-scale launch.

Taking Everything Into Consideration,

Call center automation is not just about installing a bot or setting up an IVR. It’s about reimagining borrower engagement for scalability, consistency, and care.

By auditing workflows, choosing the right tools, empowering teams, and tracking the right KPIs, microfinance institutions can unlock faster growth—while staying true to their mission of serving communities with dignity and efficiency.

At HoduSoft, we have engineered our HoduCC call and contact center software to help microfinance companies streamline their operations and deliver exceptional borrower experiences.